City managers and locally elected officials recognize the vital importance of maximizing their municipal revenues as a cornerstone of good government. The theme of an ILCMA Conference session presentation “Raising Municipal Revenues in Challenging Economic Times” was a relevant reminder that our cities must seize every opportunity to ensure that they are receiving every penny that they are due in taxes and franchise fees – not just as a strategy to help them survive a downturn, but also to ensure that they fulfill the duty of fiscal accountability to their residents and businesses.

City managers and locally elected officials recognize the vital importance of maximizing their municipal revenues as a cornerstone of good government. The theme of an ILCMA Conference session presentation “Raising Municipal Revenues in Challenging Economic Times” was a relevant reminder that our cities must seize every opportunity to ensure that they are receiving every penny that they are due in taxes and franchise fees – not just as a strategy to help them survive a downturn, but also to ensure that they fulfill the duty of fiscal accountability to their residents and businesses.

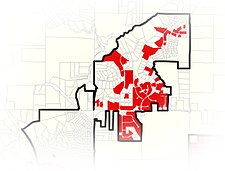

In many parts of Illinois, municipalities have seen rapid changes or expansion over the last 20 years or more. Commercial development has attracted new investment in industrial, manufacturing, and retail space, and deregulation has prompted an increase in utility providers, telecommunications service providers, and businesses making sales within a community.

How Address Records May Be Riddled With Errors

As new parcels of land are annexed and city boundaries change, a municipality should expect to generate fresh revenues. Given the speed at which many communities are changing, however, it is not unusual for local government officials to suspect that their income from taxes and franchise fees may not be increasing at the corresponding rate. In many cases, errors in tax payments are caused by taxpayers’ reliance on inaccurate or out-of-date information.

Correcting Address Databases – a Herculean Task?

It may be no easy task to uncover these errors, however, as inaccuracies may go back several years, and rooting them out may require the kind of detective work that calls for a forensic approach to data analysis.

Other obstacles may also impede efforts to track down anomalies lurking in taxpayers’ address records:

- Address information needs to be collected from multiple sources, including Geographic Information Systems (GIS), land management and community mapping, address points, ALI / ANI databases and 911 dispatch, enterprise zones, and property tax records.

- In order to establish a clear frame of reference, it is often necessary to work in concert with several municipal departments, such as finance, the City clerk’s office, the police and fire departments, building and zoning officials, planning, and water.

- Some taxpayers or utility providers may not be willing to cooperate with a municipality’s efforts to establish which addresses in the utility databases are identified as serviceable, and which of those hold active customer accounts.

- The sheer volume of data that requires standardization and analysis may overwhelm local government staff whose other duties already place heavy demands on their time and energies.

Software solutions have been developed to help deal with many of these auditing processes, such as the analysis of data supplied by utility providers and GIS to create as complete an address list as possible and then determine potential errors in a taxpayer’s database. However, a manual review may also be required to identify “exception addresses.”

The technical nature of the task and the skills issues it implies mean that municipalities often choose to outsource their address audit entirely and allow a team of specialists to work with the provider, research and verify the correction of valid errors, and determine the outstanding monies owed to their city. A statute of limitations may pertain to a particular audit, and further research may be needed in order to calculate the complete sum of payments owed.

How Can You Prevent the Future Miscoding of Addresses in Your Municipality?

There will always be a risk that errors will creep into taxpayer address records over time, especially in an area which experiences rapid growth or change, sees new residential developments, or attracts new businesses to set up headquarters within its boundaries. Local government staff need remain aware of this possibility, set up internal review procedures, and stay vigilant, conducting or outsourcing a regular analysis of possible taxable locations within their community.

City managers are recommended to take the opportunity to join together to learn from each other’s experiences and share best practices – for example, how to create an operating protocol to manage the ongoing geographic changes that almost every community undergoes. These may include:

- Maintaining a continually accruing list of geographic changes.

- Sending notice of annexations and related addresses to each utility provider via certified mail at the address on the franchise agreement.

- Monitoring individual telecom providers and resellers.

- Checking receipts from sales tax payments, particularly around municipal boundaries.

- Maintaining a business license program and reconciling it with Illinois state records.

- Keeping electronic records of all notices in a central repository, with regular backup.

An Essential Strategy for Revenue Enhancement

Municipalities that have undertaken an address audit have sometimes been able to recoup missed tax and fee payments going back several years, and benefit from a significant boost to their current and future revenues. It is no exaggeration to say that, apart from verifying the accuracy of the actual dollar amount, maximizing taxes through an address audit may be the single most important aspect of this type of revenue enhancement.